The Semiconductor Industry and Its Supply Chain

Semiconductors are the backbone for every technology - phones, cars, appliances, computers, weapons, etc. Everything is built on top of chips. Crypto, LLMs, IoT devices, or whatever new technology comes out requires state-of-the-art specialized semiconductor chips.

Because of how vital they are, chips have become political. If one country controls chip production and development, they control the world. So, who makes chips? And how are chips made? By understanding this process to some level, can we start to think about if and where we should invest money in this space?

Taiwan Semiconductor (TSM) makes most of the chips today (55% of market share). Apple, Nvidia, AMD, and others send their designs over to TSM for manufacturing. TSM is a pure semiconductor fabrication company. They make chips, really good ones. Samsung, at number two, has 17% of the market and makes the most memory chips. It has made a ~100B investment into making logic chips too as the market for memory chips is shrinking. Companies like Intel and Samsung, unlike TSM, design chips in addition to manufacturing them too. But, a lot of companies design their own chips and send it over to foundries (primarily TSM, and maybe Intel in the future) for fabrication.

Fabless semiconductor companies include AMD, Apple, Nvidia, Qualcomm, and Broadcom. TSM manufactures the majority of the chips that these companies need. Other companies are starting to design their own chips including Microsoft, Google, Facebook and Amazon. Basically, companies without fabs design chips use software (either their own like AMD’s x86, or licensed from another company like ARM). There is some push for an open-source software alternative (e.g., RISC-V) to be used. Chip design is a major determinant of a technology’s overall quality and input costs, so it makes sense that companies with growing free cash reserves want to invest into designing their own chips. As a quick aside, engineers with chip design skills should look to join (or start) chip design efforts at companies like Microsoft, Amazon, Google, and Facebook. If these companies could design their own chips at scale, successfully, that would be a tremendous value-add to their core technology businesses on the cloud, personal and mobile computing, and data centers.

Everything runs on chip-based technology and so the global demand for chips will only increase. And, as these companies continue to design their own chips, the demand for semiconductor fabrication companies to produce them will too. It is unclear which set of fabless companies will win, but we know with certainty that the entire field will succeed over time. A rising tide raises all boats. Invest in a semiconductor index.

All chips need to be fabricated, turned from software instructions into physical products. Fabrication of chips is a capital and resource intensive endeavor - get ultra-pure silicon, use lots of special chemical reagents and gases, lithography machinery and patterning equipment to etch designs onto silicon wafers at increasingly smaller nanometer scales, quality control processes, software to manage each of these steps, etc. Fabrication is not static, it requires lots of R&D (See TSM’s R&D goals here). Adding to the complexity, production must be scalable, controllable, and reliable.

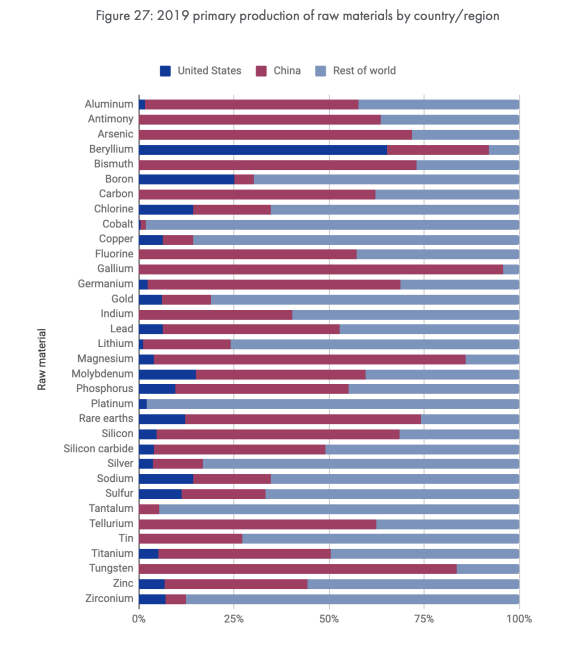

A fab requires lots of physical inputs including palladium, neon, gallium, tungsten, magnesium, photoresists, silicon wafers, photomasks and other special chemicals. This is a global effort with lots of local geographic dependencies. Silicon wafers make up 33% of total materials sales and Shin-Etsu, a Japanese company, has 29% of market share (~3B USD) in this space (CSIS report). In general, the majority of processed fabrication materials like wafers, photomasks, and photoresists come from Japanese companies. So too does most of our packaging materials (e.g., lead frames, bond wires, ceramic packages). Purified neon gas is required to operate lithography lasers and 2 Ukrainian companies produce 50% of the total neon and ship this neon to chip makers and laser manufacturers (i.e., ASML). The Russia-Ukraine war disrupted this part of the supply chain and spiked the price of neon. Now, countries and companies are looking to be more self-sufficient. TSM is setting up the systems to get their neon from Taiwan in the face of the Ukraine disruption source. Neon is not unique. There are other raw materials that are required and produced/mined overwhelmingly by other countries including palladium (Russia), gallium, tungsten, and magnesium ( all China). There is a great need for these supply chains to be more resilient and less reliant on single sources to avoid disruption, shortages, and price spikes. This graph highlights the dependence on China for raw elements needed to make chips.

Let us dive into the supply chain details, presented in summary here. Some high-level takeaways. The logic chip design market is dominated by Intel, Nvidia, and AMD with production by TSM, Intel, Samsung, GlobalFoundries and a few others (2019 market size ~74B USD); memory chip design and production (2019 size ~100B USD) is dominated by Samsung, Micron, SK Hynix. Assembly, testing and packaging (ATP) services performed after fabrication have become a bottleneck in chip performance - packaging control interconnections between memory and logic chips and the density of interconnects has increased at a slower rate than density of transistors in each of the individual chips. Leading fabrication companies do this in-house (Intel, TSM, Samsung). Applied Materials makes most of the ion implanters (2019 market size: ~1B USD) which embed dopants into silicon wafers. Photolithography equipment and software is provided almost exclusively by three companies, ASML, Nikon, and Canon (2019 market size: ~11.3B USD). ASML is the lion share leader here - it is a near monopoly. Chemical vapor deposition and conductor etching equipment is mostly provided by Applied Materials, and Lam Research (2019 market size: ~16.5B USD). Synopsys and Cadence provide much of the electronic design automation software and some core IP licensing, along with ARM (2019 market size: ~10.7B USD).

The key designers (Nvidia, AMD, Qualcomm), fabricators (TSM, Intel) and materials and equipment providers (Lam research, Applied Materials, ASML) are all neatly packaged in to the SOXX ETF.

Who will produce chips as the demand continues to explode? TSM is the likely choice, with Intel trying to make moves too. But, there is also geopolitical risk with TSM. At present, if China invades Taiwan, the semiconductor industry and subsequently, the technology world (phones, computers, cloud service providers, etc.) will be severely hamstrung. The price of a semiconductor chip will increase and delay times will grow dramatically. There is a non-zero decent chance of China invading Taiwan. But, with the U.S. pledging to defend Taiwan, this risk is lowered. I do not think China will invade Taiwan, but they might and the semiconductor industry must be prepared for that. There is a concerted effort to diversify fabrication sources geographically. The U.S. has incentivized building fabs and secure supply chains domestically, especially with the passing of the CHIPS act. TSM is building two factories (opening 2024 and 2026 making 4nm and 3nm chips respectively) in Arizona, costing ~40B USD, with the capacity to produce enough chips to meet current annual U.S. demand (source). There are labor, culture, cost and other hurdles that TSM and its suppliers are facing in Arizona adding some uncertainty into the success of this investment (source). Geopolitically, this makes sense though.

Intel CEO Pat Gelsinger wants to compete with TSM as a premier chip maker. It is Pat’s vision to diversify where fabless companies produce their chips. Intel invested 20B USD in Ohio, and will invest up to 100B to build it into potentially the world’s largest chip-making facility (source); 20B USD on plants in Arizona (source). Intel has fabs in Oregon, New Mexico, Ireland, Israel and planned fabs in Italy and Germany. The core issue with Intel is there ability to deliver on deadlines (source) and keep up with the technology on the fabrication side. The latter is a much bigger problem than the former in my books but with proper leadership it can be corrected. Intel is also facing increasing competition in their areas of dominance - PC and server chips. Intel owned 90% of the PC and server market in 2017, but in early 2023, they own 70% of the market. AMD has risen from 1% to 13% in that time period. AMD is taking their business here, and using TSM to manufacture.

If we want to generate return regardless of the inner workings of the fabrication and design race, we should look for companies that are irreplaceable and monopolistic in the semiconductor supply chain. Possible candidates include the lithography company ASML, and ion implanters/vapor deposition/etching company Applied Materials. Trading in raw materials like neon may be interesting, and will be covered in a future article. Also, there are a few key Japanese firms, like Shin-Etsu (up 50% from 7/2022 to 7/2023) that supply the wafers, photomasks and photoresists to fabricators and may be good investment candidates.

The companies to consider in more careful detail, at present, are TSM, Nvidia, AMD, Intel, ASML, and Applied Materials. Synopsys and Cadence have a duopoly on the EDA space, and as a key part of the semiconductor supply chain it warrants a deeper look. The financial analysis of these companies will be covered in the next post, but a few last comments on these companies.

With the release of ChatGPT3, the large language model (LLM) and AI hype cycle took off - just look at the YC Winter 2023 batch, MosaicML’s 1.3B deal with Databricks, or funding rounds of other generative AI companies recently. This is reminiscent of the incredible deals of crypto companies during its boom earlier in the decade. All of these AI companies require lots of compute which means lots of chips, mostly specialized GPUs that Nvidia provides. During the crypto boom mid-pandemic, Nvidia chips were in high demand and the stock soared too. LLMs and other complex ML models are wonderful and promising; companies like Nvidia are supporting their growth by building better core technology. These LLM startups are massive customers of Nvidia and other chip companies and if their businesses go to zero (high likelihood given speculative nature of these companies), Nvidia gets hurt. Nvidia stock is in the middle of a frenetic AI rally, be cautious about investments at this level.

Nvidia is not unique, most chip companies are subject to cyclicality, hype cycles, and competition. AMD and Nvidia are competitors. Intel competes in part with these two and in part with TSM. The concern with fabrication businesses is that they are capital-intensive and lower margin than design. ASML and Applied Materials are suppliers to basically every fab (TSM, Intel, Samsung, etc.) and are relatively risk-less compared to the other companies here. Semiconductor demand is unpredictable but continues to increase year over year and there is a shortage in chip supply today. This shortage is expected to persist, making companies who produce chips that much more valuable. Chips are an integral part of the future and investments here, on the whole, in the long run will be very profitable. Buy the index then consider individual investment options.

As a final comment, there are other computing technologies on the horizon. Other modalities of computing - DNA and quantum - are possibilities in the future for replacing the existing technology. My belief is that the existing semiconductor field of companies will adapt and are actively working on supporting this technology. Intel has shown that nanoscale silicon transistors that can reliably process quantum information (article), and it seems silicon-based quantum chips are possible. Google made a quantum chip too.